If you are a well-earning individual, chances are that taxes are a part of your daily life. TRACES stands for TDS Reconciliation Analysis and Correction Enabling System, which primarily focuses on two aspects of the tax paying system – Tax Deducted at Source (TDS) and Tax Collected at Source (TCS).

The users can leverage the TDS Traces website to view and then download the varying key tax documents, including Form 16, Form 16A, and Form 26 AS. Having access to these documents serves as proof of the taxes that an earning member pays each year on the annual income that they make.

This article will discuss the TDS Traces online portal, its significance, and the activation process for the account that you have on the portal.

What is the Significance of the TDS Traces Website?

The TDS Traces website has equal significance for the taxpayers and the TDS deductors to carry out a diverse range of activities about:

- Viewing and downloading the Form 26AS

- Carefully process and file for TDS or TCS statement corrections

- Keep up with the challan status

- Check the ongoing status of the different types of tax documents

- Submit a refund request for TDS online

- Download the consolidated files under Form 16 and Form 16A

- Complete the involved corrections for the previously filed TDS returns online

- Correct any issues with the OLTAS Challan

The primary significance of using the TDS Traces website is to streamline the tax-paying process online, especially when it involves subjects like TDS, TCS, etc. Instead of relying on paper-based tax payment and processing, this online portal makes everything happen online and without any complications along the way. It also reduces the risks of third-party involvement, which is another benefit to the website.

What are the Services Available through the TDS Traces website?

If you are completely clueless about the TDS Traces website and want to explore more about it and its services, here’s a quick rundown of all the services that you can access.

- Online registration for TAN (Tax Deduction and Collection Account Number)

- Online filing of the TDS statements

- Online correction in the TDS statements

- Accessing and viewing the Form 26AS.

- Registering any grievance or resolution

- Deductor services

- Taxpayer services

- Pay and Accounts office services

Given that everything is available online, it makes the processing of each of these services quite streamlined and manageable.

How can you Register on the TRACES website?

Now that you have a fair idea about the available services on the platform, you must be inquisitive about the registration process. Ideally, it isn’t as complicated as it seems, provided that you follow the right steps.

Here’s what you need to do for the registration process:

- The first step is to open your browser and then go to the search bar

Register on the TRACES website

https://contents.tdscpc.gov.in/en/home.html

Now that you have a fair idea about the available services on the platform, you must be inquisitive about the registration process.

- Once you are on the homepage, you need to click on “Register as new”. You can register as a deductor, taxpayer, etc.

- During the registration process, you need to keep the PAN details, date of birth, and name of the taxpayer handy. These are crucial details you need to process the registration.

- Once you have entered the necessary as asked, you need to click on Create Account. This will redirect you to a webpage with all the entered details. If you find something wrong in the details, you can edit them before confirming the submission of the details.

- Once you are sure that all the data entered is correct, your account will be created using an activation link. You will receive an activation code to the registered email ID and mobile number.

In case something is wrong with the account or you wish to change any details about your account, you can go ahead and call customer care with your issues. The customer care number is 1800-103-0344. Alternatively, one can email at contactus@tdscpc.gov.in.

What are the Individual services offered to the Deductor?

If you are registering on the TRACES website as a deductor, there is a list of exclusive services that are offered under the website. These include individual services like:

- Registration of admin user for a TAN

- Viewing challan status

- Download Form 16/16A

- View the PAN Master for the TAN

- Viewing statement status

- Manage the user profile and the associated password

- Validate different certificates

- Online correction of details

- TDS refund

- Offline correction, etc.

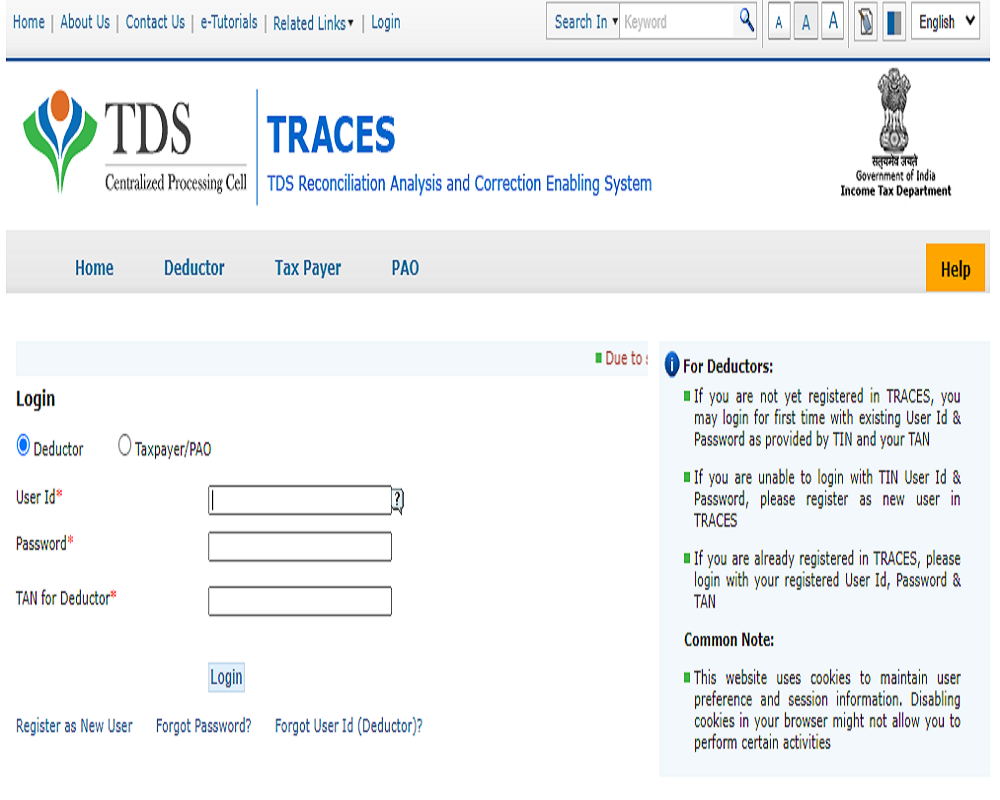

How to Log in to TRACES using Registered TAN?

Once you have registered yourself to the TDS TRACES website, knowing the login process is equally important. How can you sort out the login process?

Here are a few steps that you can follow along:

- Login to the TDS-CPC portal

- Under that, you need to click on “Login”, which will redirect you to the login page

- In there, enter the Login ID and the password, which includes the TAN number

- Click on GO

- You need to confirm and verify the profile using the personal details

- Once done, click on Submit

- You can then log into the portal using the activation link that you receive to your email or registered mobile number

Conclusion

With so many different types of services offered on TDS TRACES, keeping up with the website is a must for every taxpayer. We hope that this comprehensive guide gives you an overall idea of the registration and login process and also the kind of different services that you can readily avail of from the website, both as a taxpayer and a TDS deductor.

FAQs

Can I request a status check via TRACES?

Yes, users can request a status check for any grievance or issues that have been submitted by the users on the portal.

What online correct services are available at TRACES?

Traces offers multiple ranges of online correct services involving TDS and taxing processes that the users can keep a check on.

Is the TRACES website safe?

Yes, the website is government-run and entirely encrypted, so you won’t have to worry about safety or privacy issues.

Online casino

Online casino